Bonds

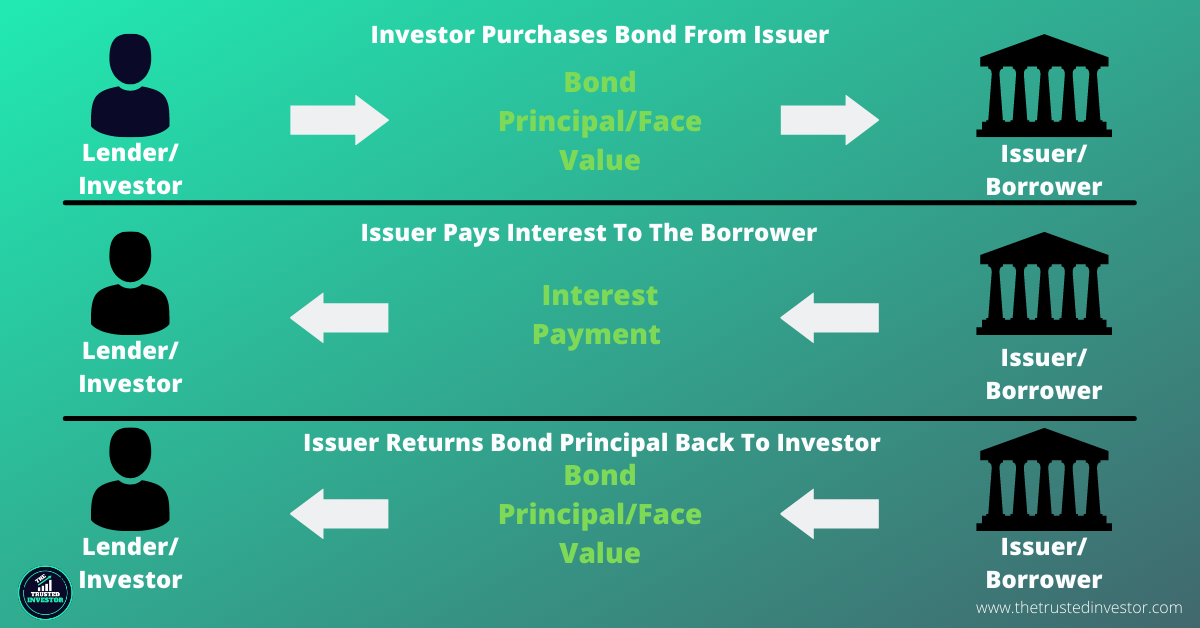

Bonds are a form of debt issued by a company or government that wants to raise some cash. In essence, when an entity issues a bond, it asks the buyer or investor for a loan. So when you buy a bond, you're lending the bond issuer money.

In exchange, the issuer promises to pay back the principal amount to you by a certain date and sweetens the pot by paying you interest at regular intervals—usually semi-annually

In Tanzania bonds are mostly issued by the government in terms of Treasury bills and Treasury bonds,though corporate bonds are also available

TREASURY BILLS

Treasury bills are short-term government securities, which are issued at discount and mature in less than a year. Currently, the Bank of Tanzania issues on behalf of the Government of Tanzania, treasury bills in four maturities, namely 35, 91, 182 and 364 days. The minimum bid amount for Treasury bills is TZS 500,000 (Five Hundred Thousand Tanzania Shillings in multiples of TZS 10,000.

TREASURY BONDS

Treasury bonds are long-term debt instruments with a maturity period of more than one year and pay interest on semiannual basis. Treasury bonds issued by the Bank of Tanzania are in six maturities: 2, 5, 7, 10, 15 and 20 years. They are issued at fixed interest rate (coupon). The minimum bid amount for Treasury bonds is TZS 1,000,000 in multiples of TZS 100,000

REWARDS & RISKS OF INVESTING IN BONDS

Advantages of Bonds

>.They are relatively risk free when they are issued by the Government.

>.The rate of return is competitive

>.Treasury Bonds can be transferable and can be used as collateral(dhamana/amana)

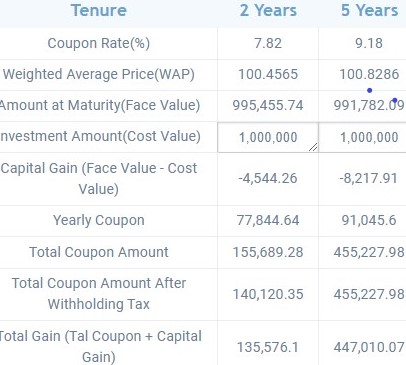

Bond Interest Calculator

Risks of Bonds

- Credit Risk — The risk that a bond's issuer will go into default before a bond reaches maturity

- Market Risk — The risk that a bond's value will fluctuate with changing market conditions

- Interest Rate Risk — The risk that a bond's price will fall with rising interest rates

- Inflation Risk — The risk that a bond's total return will not outpace inflation

Corporate Bonds

As of date one of the companies to have offered corporate bonds in Tanzania was the NMB Bank which offered a 10% interest rate per year for 3 years from 2019-2022 and the minimum investment amount was 500,000tzs.

How to buy Treasury Bonds

First, investors who are interested in buying stocks in Tanzania need to open an account with one of the Dar Es Salaam Stock Exhange brokers.

You can buy a bond either in the primary market at the Bank of Tanzania or you can buy a bond in the secondary market at the Dar es Salaam Stock Exchange. What you need to do is place an order with your stockbroker or your banker – both of them have access to both the Bank of Tanzania and the Dar es Salaam Stock Exchange

DSE STOCK BROKERS

The following are some of the contact information of stock brokers available for more information

- TIB RASILIMALI LIMITED: P.O. Box 9154 7th Floor, Samora Tower, DAR ES SALAAM Tel: 255 22 2111711 Mob: +255 0744 777818 E-Mail: rasilimali@africaonline.co.tz

- ORBIT SECURITIES COMPANY LIMITED: P.O. Box 70254, DAR ES SALAAM 4th Floor, Golden Jubilee Towers, Ohio Street, Tel: +255 22 2111758, Tel: +255 22 2120863, Fax: 255 22 2113067 , E-mail: orbit@orbit.co.tz

- TANZANIA SECURITIES LIMITED: P.O. Box 9821 DAR ES SALAAM Jangid Plaza, Unit No. 201, 2nd Floor, Plot No. G6, Kinondoni Chaburuma Street Off Ali Hassan Mwinyi Road, Next To St. Peters Traffic Lights Ada Estate Tel: 255 (22) 2926578, Fax: 255 (22) 2112809 Mob: +255 718 799 997 E-Mail: info@tanzaniasecurities.co.tz Website: www.tanzaniasecurities.co.tz

- SOLOMON STOCKBROKERS LIMITED: PSSSF House, Ground Floor, Samora Avenue /Morogoro Road P.O. Box 77049, Dar-es-Salaam Tel: 255 22 2124495, Mob +255 764 269090 /+255 714 269090 E-Mail: solomonstockbrokers@solomon.co.tz Twitter/Instagram: @sstockbrokers